In the slow days of summer, it seems like journalists sometimes distract themselves from watching cat videos by writing apocalyptic stories about how everything on their beat is going to hell. Lately, there’s been a spate of clickbait headlines (including this one) about the Apple Watch and how it’s failing in the market — more or less on schedule of reporters’ typical three-month attention span. (In January 2014, wearables were going to save the world. When it didn’t happen by April, we were treated to miles of copy about how it was all a big fraud.)

In the slow days of summer, it seems like journalists sometimes distract themselves from watching cat videos by writing apocalyptic stories about how everything on their beat is going to hell. Lately, there’s been a spate of clickbait headlines (including this one) about the Apple Watch and how it’s failing in the market — more or less on schedule of reporters’ typical three-month attention span. (In January 2014, wearables were going to save the world. When it didn’t happen by April, we were treated to miles of copy about how it was all a big fraud.)

These days, three months after ordering opened for the Apple Watch, it’s easy to find stories that say no one’s buying the thing, that the whole thing was overblown, and that Apple will inevitably leave a crater where its new headquarters stands. So let’s take a look, shall we?

The first thing to understand is that the only numbers that are anything but guesswork come from a company called Slice Intelligence. Slice’s figures come from scanning the emails of a panel of about 2 million volunteers for order receipts. As samples go, that’s not bad. But remember that all the numbers you see are based on sampling methodology and not actual audited shipment numbers. Also, it’s not clear what the geographic bias of Slice’s panel is. Other figures from Slice about the wearables market omit Xioami, which is strong in Asia to the point that it challenges Fitbit’s numbers globally. We suspect that Slice’s sample under-represents Asian markets.

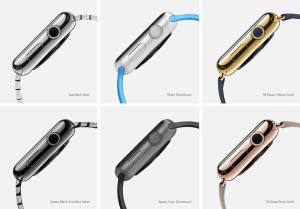

That all said, Slice is saying that after the first month surge, Apple is selling fewer than 20,000 watches a day in the United States, and that two-thirds of them are the least-expensive ($349) Sport watches. (Fewer than 2,000 of the $10,000 Edition watches have been sold in the United States, Slice says, a number that surprises us not in the least.)

Could one expect that June is a big month for watch sales? Maybe. It’s not a big tech sales month — tech sales don’t take off until August for Back to School, and then again in November for the holiday. But Father’s Day is in June, so maybe it’s a wash. In any event, it’s not unreasonable to think that sales might pick up toward the end of the summer.

Twenty thousand units a day from June to December is 4.2 million units. Say the watch sold 2 million in April and May; that’s projecting 6.2 million watches in the U.S. for 2015 assuming flat sales for the rest of the year. Double it for the global market (for no particular reason other than reasonableness; if you have a better model, let’s hear it), that’s 12.4 million units for 2015 worldwide. And for the hell of it, let’s say that Slice’s estimate of 66 percent of sales being the Sport at $349 and 34 percent being the regular watch at $600, for an average selling price of $433. (Let’s ignore add-on watchbands and the gold Edition as rounding error.)

Is that disappointing? Actually, yes, at least among analysts. Fortune asked them back in March — before orders opened, and all most of them knew was what they learned from the September unveiling — for their 2015 projections of watch sales. They averaged 22.4 million units, at an average selling price of $416, somewhat lower than Slice’s estimate. So we have some choices here:

- The Slice numbers are correct.

- The Slice numbers are correct, but sales are in a summer doldrums and will pick up as the year goes on.

- The Slice numbers understate sales.

- International sales are stronger than U.S. sales, and our 2x guesstimate here is too low.

- Analyst expectations are nonsense and overheated.

- The Watch is, indeed, being rejected by the market.

Our personal guess is that the analysts are modestly overheated, our international guesstimate is wrong but not very, that Slice’s sample undercounts somewhat, and that sales will pick up at the holiday season.

And ultimately, does it matter for Apple? Reputationally, sure; home-run products are good and Apple’s been hitting singles and doubles. Haters gonna hate. Financially, no; Apple sold something north of 50 million iPhones in the second quarter, and 2 million watches won’t move the needle very much.

We won’t really know anything about how Apple Watches have sold until August. That’s when Apple announces its quarterly earnings, assuming it breaks out watch sales, which it might not. But by August, IDC, IHS, and the rest of that crowd will publish their 2Q numbers, which are rigorous and based on hard data. Then we can start arguing about trend lines, because all we’ll have is one data point, and a trend line with only one data point isn’t really a trend line.